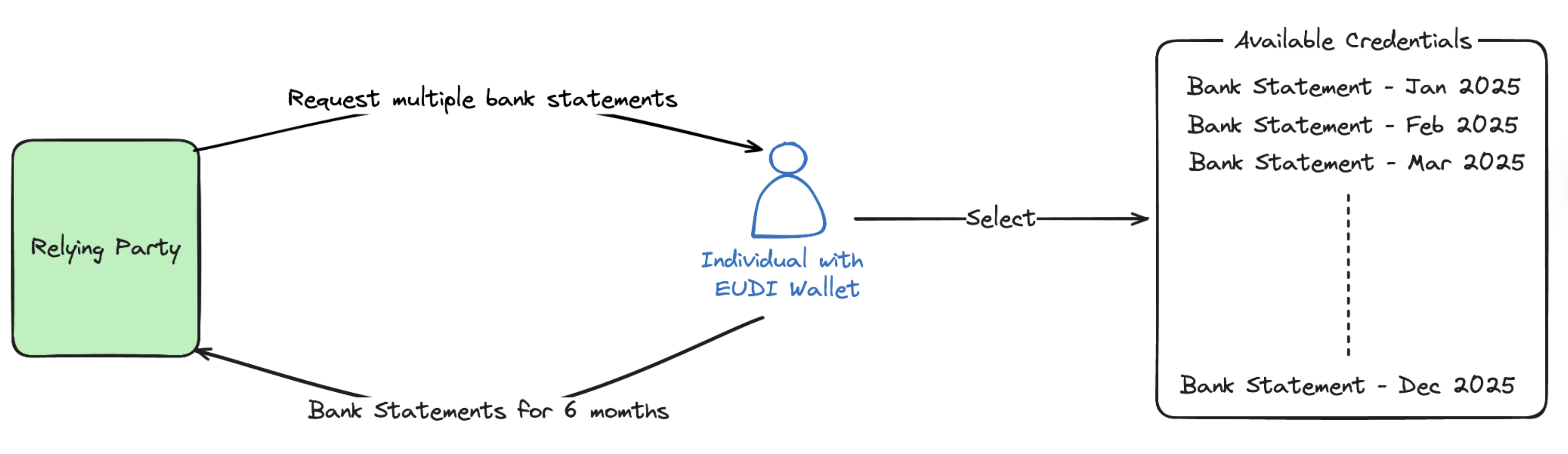

DCQL – Loan application with multiple recent bank statements

This workflow shows how a loan provider (Relying Party/Verifier) can request multiple recent BankStatement credentials as part of assessing a loan application. By setting the DCQL query's multiple field to true, several instances of the same BankStatement credential (for example, the last six monthly statements) can be presented in a single verification flow.

For the underlying DCQL query, diagram and narrative, see the “Loan application with multiple recent bank statements” use case in our DCQL concepts article.

Step 1: Get the API Key (Issuer Admin)

To obtain your API key, please contact [email protected]. Once you have received your API key, enter it in the field below and click the Set API Key button to save it for future use.

Step 2: Create Credential Definition (Issuer Admin)

To create a credential definition, run the code block below using the Run button. Alternatively, you can manually copy the code block and use it in the body of the API request available here.

Note: The

kidvalue is mandatory with trust anchorx509. To obtain thekidvalue for the respective organisation use the API available here.

From the API response, copy the credentialDefinitionId and id value from the credentialDefinitions array for use in the Step 3.

The issuer can define credential definition for the BankStatement of credential format dc+sd-jwt

Bank Statement

A Bank Statement credential provides verified financial information including account details, transaction history and balance information. It serves as a proof of financial stability and is commonly required for loan applications and financial assessments in accordance with European banking regulations and Anti-Money Laundering directives.

Request

Response

Step 3: Issue and Receive Credential (Issuer/Holder)

The holder of the wallet submits a request for the issuance of a credential by executing the JSON code block below using the Run button in InTime issuance mode. Choose the credential format and replace <credentialDefinitionId> and <id> with the actual values obtained from the previous step. Alternatively, you may use the API available here.

Note: The user needs to issue credentials for multiple recent Bank Statements to the holder wallet with the respective

credentialDefinitionIdandidobtained from the response body in Step 2.

After receiving the response, toggle the button provided to dynamically generate a QR code. The EUDI Wallet/Holder can then accept the credential offer using the Data Wallet (or any other EU Digital Identity Wallet) by either scanning the QR code or directly accessing the credential offer on their mobile device, such as via a browser.

Bank Statement

Request

Response

To receive and accept the credential via API. First, use the credentialOffer to call the Receive Credential API. Once you have the response, copy the credentialId and provide it at Accept Credential API to accept the credential.

Step 4: Create Presentation Definition (Verifier Admin)

To create a presentation definition for requesting proof, you can run the code block below using the Run button. Alternatively, you can manually copy the code block and use it in the body of the API request provided here.

Note: The

kidvalue is mandatory with trust anchorx509. To obtain thekidvalue for the respective organisation use the API available here.

Request

Response

Once a presentation definition is created, the presentationDefinitionId can be reused to verify multiple credentials (Step 6).

Step 5: Create Verification Request (Verifier/Relying Party)

To create the verification request, execute the code block below using the Run button. Alternatively, you can manually copy the JSON and use it in the body of the API available here.

After receiving the response, toggle the button provided to dynamically generate a QR code. The EUDI Wallet/Holder can then accept the verification request using the Data Wallet (or any other EU Digital Identity Wallet) by either scanning the QR code or directly accessing the verification request on their mobile device, such as via a browser.

Request

Response

Users can copy the presentationExchangeId from the JSON response for use in Step 7 to read verification history.

Step 6: Send and Receive Verifiable Presentation (Holder)

The holder wallet accepts (consents) to send the requested credentials.

- Receive Verification:

- Use the

vpTokenQrCode(step 5) with the API available here to receive the verification. - Copy the

presentationIdfrom the JSON response received from Receive Verification for use in Step 6b.

- Use the

- Filter Verification:

- Use that

presentationIdwith the API available here to find matching credentials. - Save the

<id>and<credentialId>from the response.

- Use that

- Send Verification:

- Use the

presentationId,<id>and<credentialId>with the API available here to send the credentials to the verifier.

- Use the

Step 7: Send and Receive Verifiable Presentation (Verifier/Relying Party)

- The Verfier (Relying Party) receives the requested credentials and can verify it. They may read the received credential by executing the Read Verification History API.

- From the response received, the

vpTokenResponsecan be decoded using JWT Decoder. - From the decoded response, the

verifiableCredentialinside the 'vp' can be further decoded to view the received credentials.